Suze Orman: Why Everyone Should Buy Treasuries

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

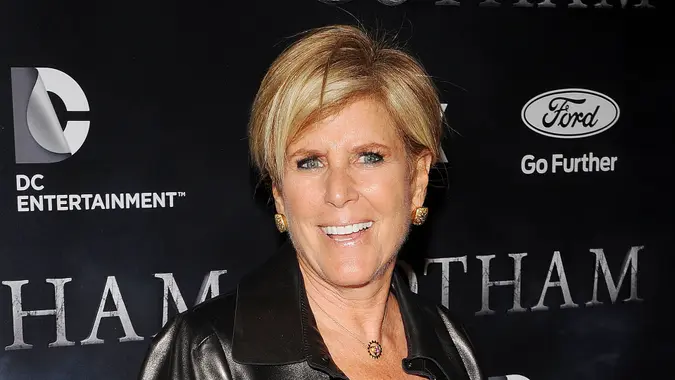

When it comes to bonds, personal finance expert and New York Times bestselling author Suze Orman is a big proponent of buying Treasuries.

“Treasuries are used to fund the national debt. And as I just said, they are considered the safest of all bonds because they are backed by the full faith and credit of the United States government,” Orman said in an October 2023 episode of her Orman’s Women & Money podcast.

Orman said that she has been investing in them, recommending to her listeners to do the same and allocate a portion of their portfolio to Treasuries, especially shorter-term ones.

“I still think it is wise to be investing in the three and six-month Treasury bill,” she added.

Bonds — and Treasuries — are generally considered safe and part of a conservative investment approach. These can also help buffer potential stock market downturns.

As Fidelity explained, a Treasury bill — or T-bill — is a short-term loan issued by the federal government, which matures in one year or less from the date of purchase.

In other words, you will get repaid the amount plus interest within a year — and as they are government-backed — they are considered safe.

Meanwhile, Treasury bonds — T-bonds — are long-term debt obligations that mature in terms of 20 or 30 years. As Fidelity noted, here, the interest rate is fixed for the bond’s entire term.

Morgan Stanley for instance, recommends that cautious investors should consider ways to protect their portfolios in the current economic landscape, including by investing in Treasuries.

Part of Morgan Stanley’s rationale is that the economy has not yet felt the full pinch of the Federal Reserve’s tighter monetary policy. In turn, an economic slowdown could push Treasury yields lower and prices higher, especially if the Fed lowers rates this year.

Written by

Written by  Edited by

Edited by