4 Ways to Talk to Your Partner About Debt

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

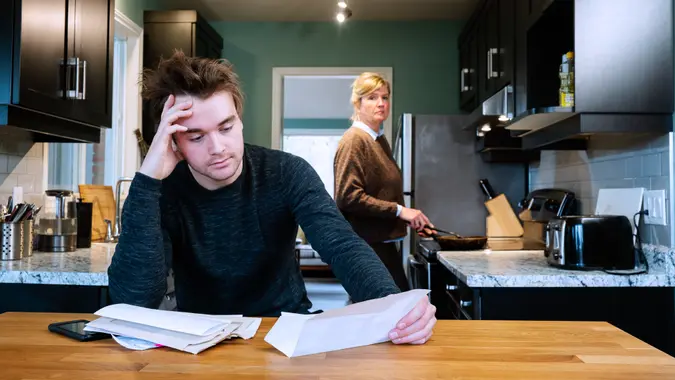

It’s no secret that money issues — including debt — can put a serious strain on marriages and other relationships. A 2018 Harris Poll of 1,400 U.S. adults found that money was the leading cause of stress for married couples, at 36% of respondents. Younger adults were almost twice as likely as older adults (55 or older) to cite money as the top stressor.

The problem is compounded when one partner hides money issues from the other partner. As Experian noted in a blog, it’s important to have a postnuptial conversation about money matters — especially for those who have secretly struggled with high credit card debt.“Whether you entered the marriage with debt or quietly accrued it after marrying, it’s critical to talk to your spouse as soon as possible, as it impacts both of your lives and finances,” according to Experian.

The challenge is bringing debt problems up to begin with. A good first step is to seek advice from debt specialists such as National Debt Relief, a debt settlement and counseling company that also specializes in marital debt relief.

Marital debt refers to expenses incurred during your marriage, such as credit cards, mortgages, car loans and medical bills. National Debt Relief helps couples follow a strategy to pay down debt and learn to compromise on their finances.

If you need help starting the conversation in the first place, here are four ways to talk about debt with your partner.

1. Start Early

The time to start talking about money is as soon as you and your partner commit to a serious, long-term relationship. As National Debt Relief notes on its website, if you want to start off on the right foot it’s important to discuss finances before you get married. Take the time to explain to each other how you envision managing money as a newly married couple. To avoid arguments, come up with financial compromises you’re both comfortable with.

Open and honest communication is key.

2. Be Accountable

Keeping secrets can spell doom for a relationship. There’s even a name for hiding debt and other financial information from your partner: financial infidelity. No matter when you accumulated the debt — before moving in together or after getting married — you need to own up to it as soon as possible so you and your partner can develop a plan to tackle it.

3. Make a Plan

Strategies for dealing with debt vary depending on the type and amount of debt you have, as well as your overall financial situation. Potential solutions could be simple, like creating a budget together, or you might need expert help from a company like National Debt Relief that specializes in debt settlement and consolidation.

Using this strategy, you could pay off your debt for significantly less than you owe.

Here’s how it works: First, tell a Certified Debt Specialist at National Debt Relief a bit about your situation in a free, no-obligation consultation. Then, if you’re eligible and interested in their program, they’ll put together a customized plan that’s right for you and your budget.

With debt settlement, National Debt Relief’s experts will negotiate directly with your lenders on your behalf to agree on a reduced balance, so you could pay less than what you owe and get out of debt much faster.

With debt consolidation, all your debt will be combined into one new loan, ideally with a lower interest rate. This will help you pay off your balance faster and save you money on interest payments in the long run.

National Debt Relief’s experts will help you weigh the pros and cons of all your options and can help you with the following types of debt:

- Credit Cards

- Personal Loans

- Lines of Credit

- Medical Bills

- Collections

- Repossessions

- Business Debts

- Certain Student Debts

4. Create a Budget

This is one of the most effective ways to talk about debt. Not only does it give you a built-in way to have a tough conversation, but it also gives you a clear picture of how much money you have coming in, how much is going out and how much you can devote to getting your debt under control.

There are numerous options to help you get started, including spreadsheets and budgeting apps. Budgets allow you to assess your financial health, reduce stress, set and achieve financial goals (including paying off debt), prepare for the future and improve your relationship.

More From GOBankingRates

Written by

Written by