3.5M+

Instagram Followers

952K+

Twitter Followers

2.66M+

YouTube Subscribers

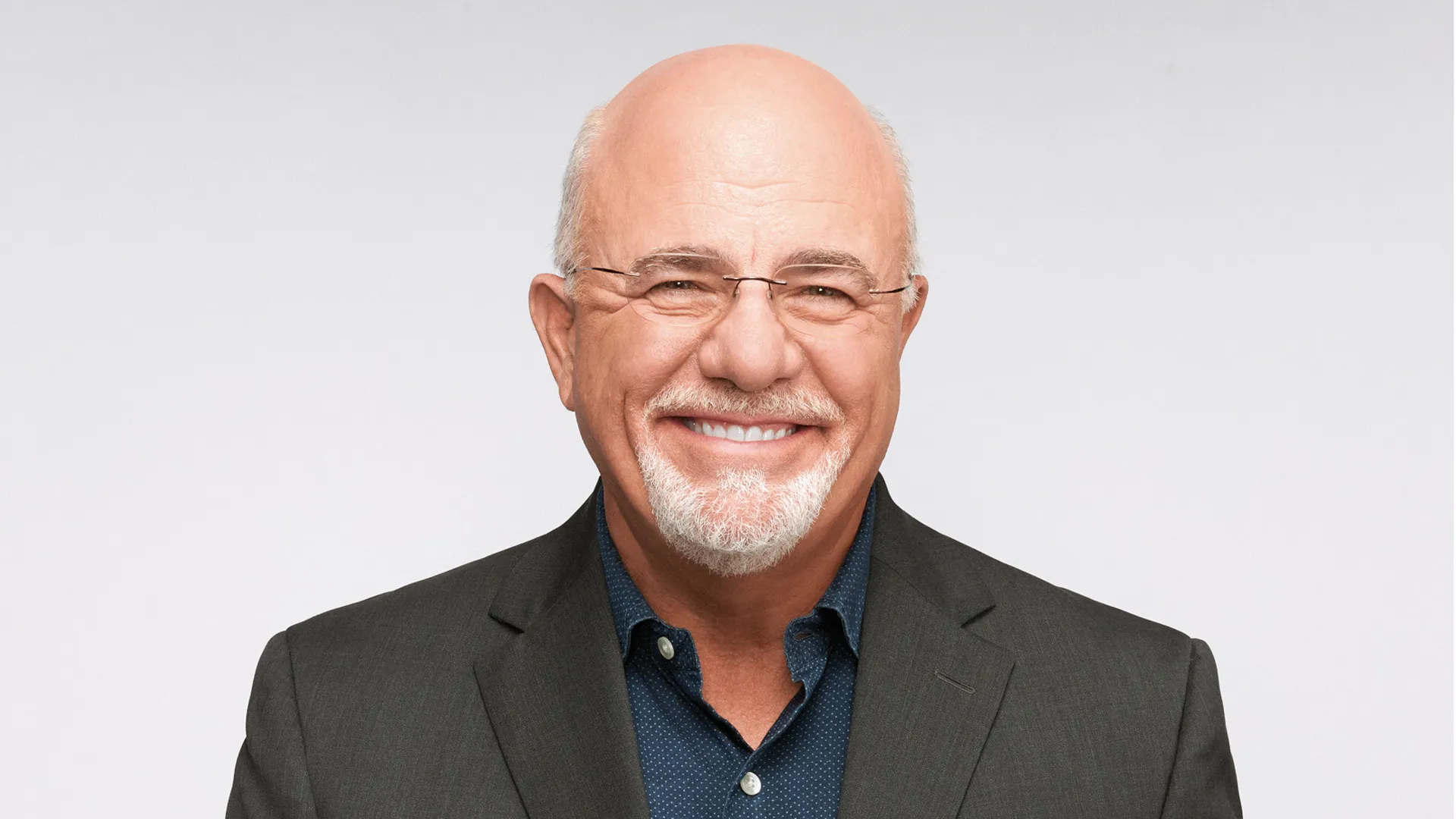

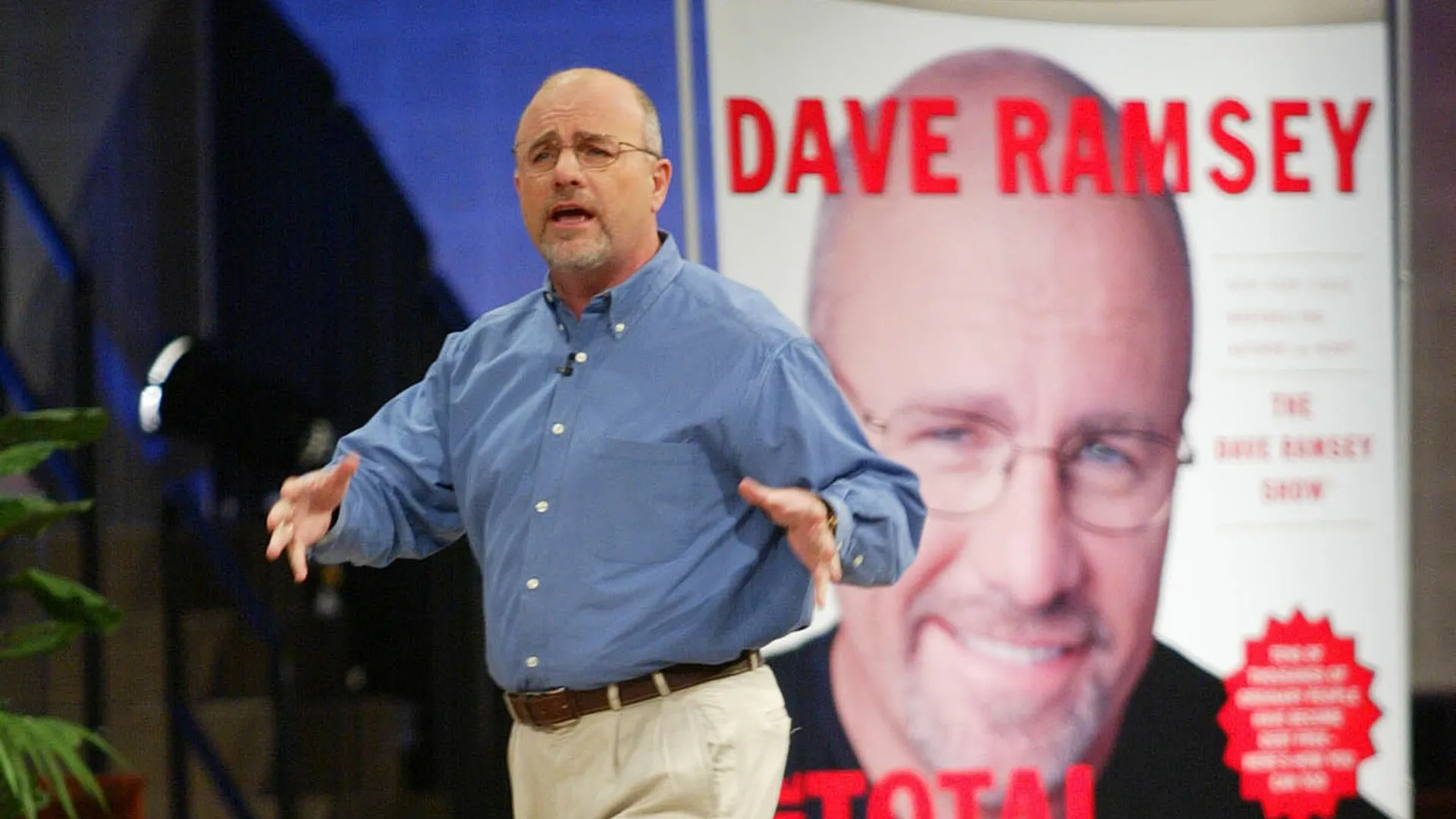

Biography:

Dave Ramsey is a personal finance expert, bestselling author of numerous books including “The Total Money Makeover” and host of the financial advice show “The Ramsey Show,” heard by 23 million listeners every week. He is also the CEO of the company Ramsey Solutions, which connects people with plans for financial success in numerous areas such as getting out of debt and saving for retirement.

As someone who has dealt firsthand with high levels of debt and even bankruptcy, Ramsey became motivated to help others avoid the pitfalls he fell into. Since 1992, he has worked to build up a team of experts and distribute advice to help people take control of their money, build wealth and improve their lives.

Why He’s a Top Money Expert:

Dave Ramsey is one of the most recognizable names in personal finance, with a total audience reach of about 30 million between social media and his radio show.

Q&A:

What’s the one piece of money advice you wish everyone would follow?

Cut up your credit cards and get out of debt. You need to get on a written, monthly budget and tell your money where to go, instead of wondering where it went. You might even feel like you got a raise.

What common money advice do you think people should not follow?

Don’t get caught up in get-rich-quick schemes or leverage debt to try to build wealth. Common sense is an oxymoron when it comes to most financial advice today.

What’s the best thing you’ve personally done to build your wealth?

Playing longball and investing consistently. Mutual funds are the way to go. They cast a wide net across many companies, helping you avoid the risks that come with the trendy stuff, like crypto. Just remember, match beats Roth beats traditional on figuring out where to invest for retirement first.

What’s the biggest financial mistake you made, and what did you learn from it?

I hit rock bottom and filed for bankruptcy in 1988. I had built my real estate portfolio using debt, then the bank called in my loans. I met God on the way up but got to know Him on the way down. Without making those mistakes with a lot of zeros on the end, I wouldn’t have learned to manage money the right way. That’s why Ramsey Solutions was built around “God’s and Grandma’s way” of handling money.

Top Offers

Money Advice From Experts