505K+

Instagram Followers

314K+

YouTube Subscribers

1M+

Total Audience Reach (Twitter, Instagram, YouTube and TikTok)

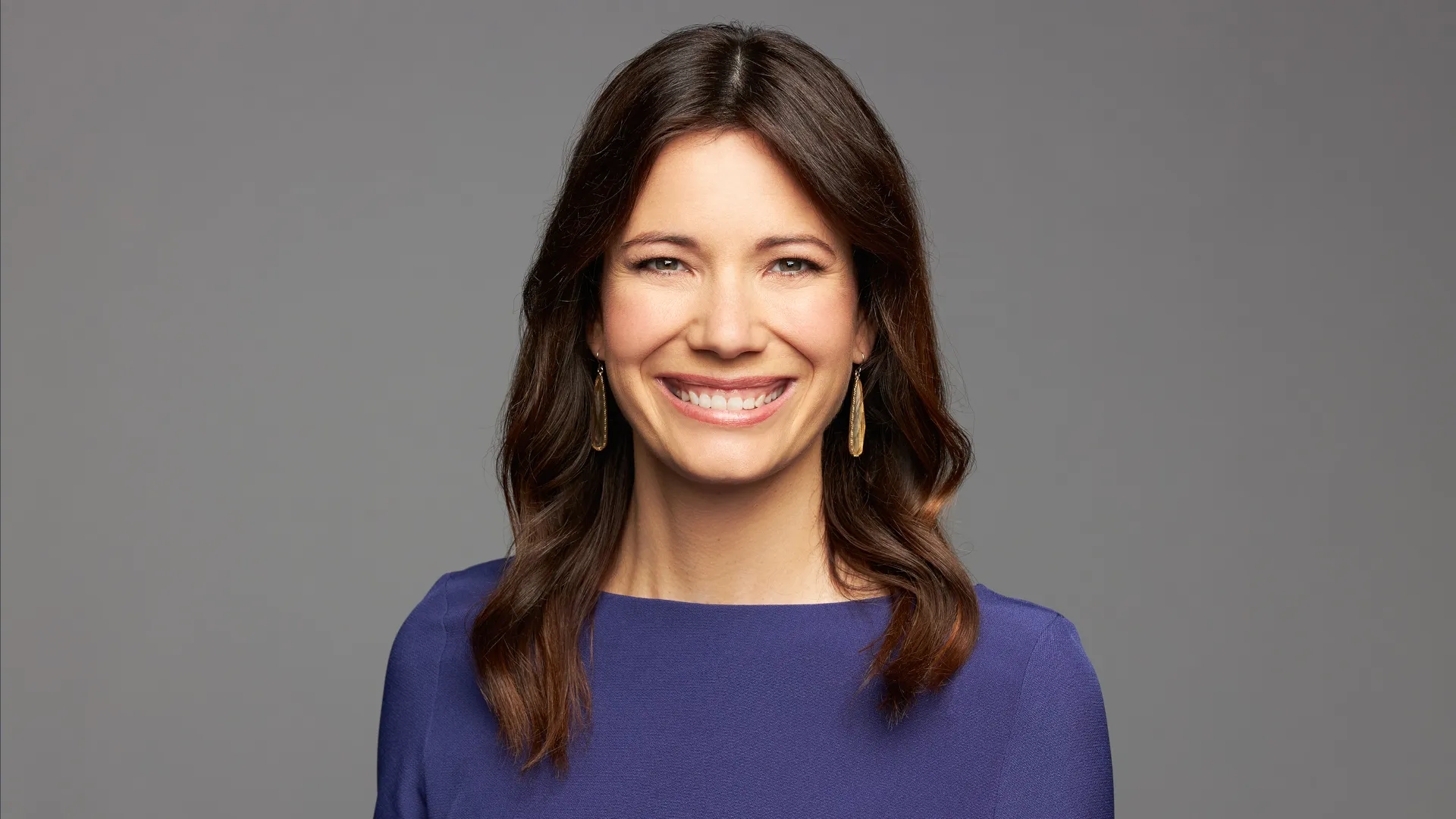

Biography

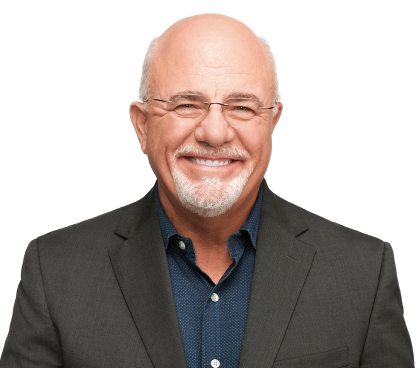

Rachel Cruze is a personal finance expert and the author of “Know Yourself, Know Your Money.” She is also the host of “The Rachel Cruze Show,” where she shares practical tips to save more money, get out of debt quickly and make progress toward your financial goals. She has previously been recognized by GOBankingRates as one of Money’s Most Influential. She is also the daughter of fellow Top Money Expert Dave Ramsey.

Why She’s a Top Money Expert

Cruze focuses on helping people manage their money, get out of debt and also have fun. She uses her social platforms to inform and educate, giving practical advice and applicable tips that anyone can use.

Q&A

What are your top money-saving hacks for staying afloat amid inflation?

Create and follow a zero-based budget, which is your income, minus expenses (including giving and saving), equals zero. A lot of people say they are on a budget but aren’t actually tracking it. Once you’re on a budget, you can focus on your four walls first, (shelter, food, utilities, and transportation), then start looking at where you can find margin.

What advice would you give to someone who is new to budgeting?

Give yourself grace and at least three months to get into a rhythm. It takes a couple of months to see your money patterns and habits take shape. I always suggest to always physically track your spending- whether it’s on a piece of paper, a spreadsheet or an app.

What’s the best thing someone can do for their financial health?

Recognize your money tendencies and find contentment. You can spend your whole life trying to keep up with the Joneses, but they are more than likely broke. Get on a budget, get out of debt, and then start investing for your future.

What is the worst thing someone can do for their financial health?

Comparison is the thief of joy. Don’t compare your debt free lifestyle with people who go into a lot of debt, because they are going to look like they are doing much better than they actually are.

Top Offers

Money Advice From Experts