How Much Money Do Americans Have in Their Bank Accounts in 2024?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Americans are under immense financial pressure. While inflation is evening out, prices for many everyday expenses remain high, and high interest rates are leading to larger mortgage and car payments for many consumers. With the cost of living so elevated, many Americans are living paycheck to paycheck.

A recent GOBankingRates survey found that 49% of Americans live paycheck to paycheck throughout the year, with an additional 22% living paycheck to paycheck at least part of the year. All of these pressures are impacting Americans’ ability to save money and build wealth.

To better understand how the current economy is impacting Americans’ bottom line, GOBankingRates surveyed more than 1,000 Americans ages 18 and older from all across the country to find out how much Americans have in their savings and checking accounts — and the results were alarming. Here’s what we discovered.

Key Findings

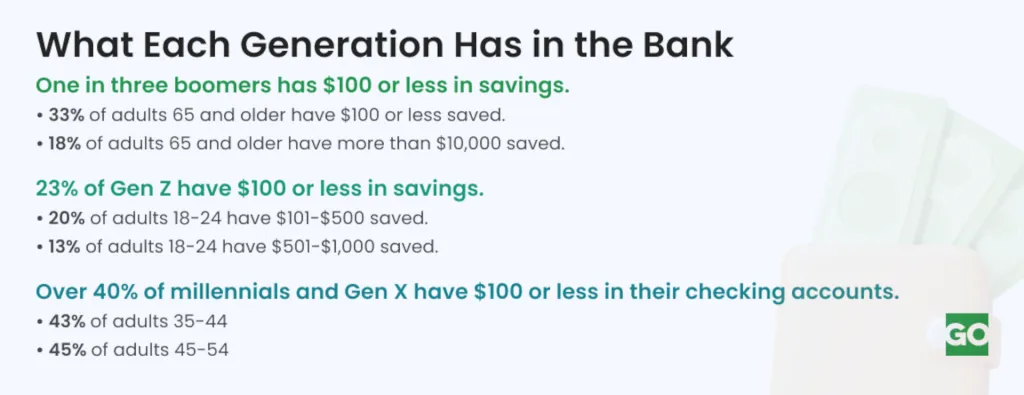

- The largest proportion of those surveyed (38%) have $100 or less in their checking accounts.

- Half of Americans have less than $500 in savings, with 36% having $100 or less in savings.

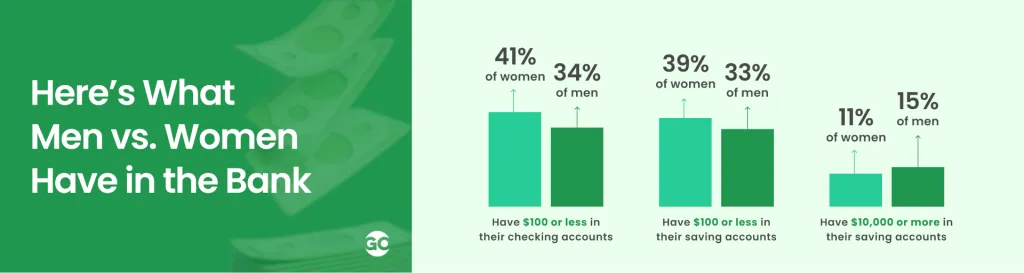

- Women have less money in the bank than men do.

Overdraft Struggles

With many Americans having low checking account balances, it’s no surprise that a good portion have overdrafted their accounts. The GOBankingRates survey found that 28% of Americans have had an overdraft on their checking account in the past year, with 6% admitting that this has been a frequent occurrence.

Millennials are the most likely to have overdrafted their accounts, with 33% of those ages 25 to 34 and 34% of those ages 35 to 44 stating that they have overdrafted their accounts in the past year. Those in the 25-34 age range were most likely to say that this is a frequent occurrence.

Americans ages 65 and up were the least likely to overdraft their accounts, with just 19% stating that this had occurred over the past year. Within this age group, 66% said they had no concerns about an overdraft over the past year.

How Much Should You Have in Your Savings and Checking Accounts?

The exact amount of cash you should keep in your savings and checking accounts will vary from person to person.

“The right checking and savings balances are unique to your financial situation,” said Seth Diener, private wealth manager at Diener Money Management. “Assess your expenses, income stability and risk tolerance to determine how much you feel comfortable keeping readily available.”

While the exact amounts needed will depend on the individual, it’s likely that the $100 many Americans keep in these accounts is not enough.

“Try to have three to six months of living expenses in a savings account for an emergency fund,” Diener said. “This helps cover unexpected costs without going into debt. If you have under three months of expenses saved, make building up your emergency fund a priority. Even small, regular contributions help grow your savings over time.”

As for your checking account, you should have more than enough to cover your monthly expenses.

“Aim to keep one to two months of living expenses in your checking account as a buffer,” Diener said. “This helps avoid overdraft fees and having to transfer from savings frequently.”

Methodology: GOBankingRates surveyed 1,063 Americans ages 18 and older from across the country between Nov. 27 and Nov. 29, 2023, asking 22 different questions: (1) What category best describes your current financial institution?; (2) Have you considered changing banks within the past year?; (3) If you have considered changing banks in the past year, were any of the following factors? (Select all that apply.); (4) Which feature, perk or other offering is most important to you when opening an account with a new institution?; (5) Are you currently satisfied with all of the banking products and services offered by your bank/credit union?; (6) Would you ever have different types of accounts across multiple banks (i.e. checking at Chase, but savings at TD Bank)?; (7) What is your most preferred method of banking?; (8) Which of the following is the biggest factor of you staying with your current bank?; (9) Which of the following bank accounts do you currently use/have open? (Select all that apply.); (10) How much is the minimum balance you keep in your checking account?; (11) How much do you currently have in your savings account?; (12) What amount of a sign-up bonus would make you consider switching banks?; (13) Have you considered using any app-only banking platforms (aka neobanks) in the past year (e.g. Current, Chime, Dave, etc.); (14) How important is it to you for your bank to be affiliated with a crypto exchange/platform?; (15) In the past year, how often have you written a physical check?; (16) When was the last time you visited your bank in person?; (17) Why would you choose to visit your bank in person? (Select all that apply.); (18) Have you had an overdraft on your checking account in the past year?; (19) How much do you trust your current bank to act in your best interest?; (20) How much do you trust your current bank to protect your private information?; (21) Do you trust regional banks more than national banks?; and (22) How much cash do you keep at home? GOBankingRates used PureSpectrum’s survey platform to conduct the poll.

Written by

Written by  Edited by

Edited by