How To Write a Check: A Visual Guide

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

While it’s so easy to simply swipe your debit card at the cash register or to pay your bills online, the paper check has not yet met its demise. There are times when writing a check is the easiest way — or the only way — to pay for goods or services.

As long as it’s considered a valid form of payment, you should know how checks are written. Follow this guide using written check examples so you can avoid any mistakes.

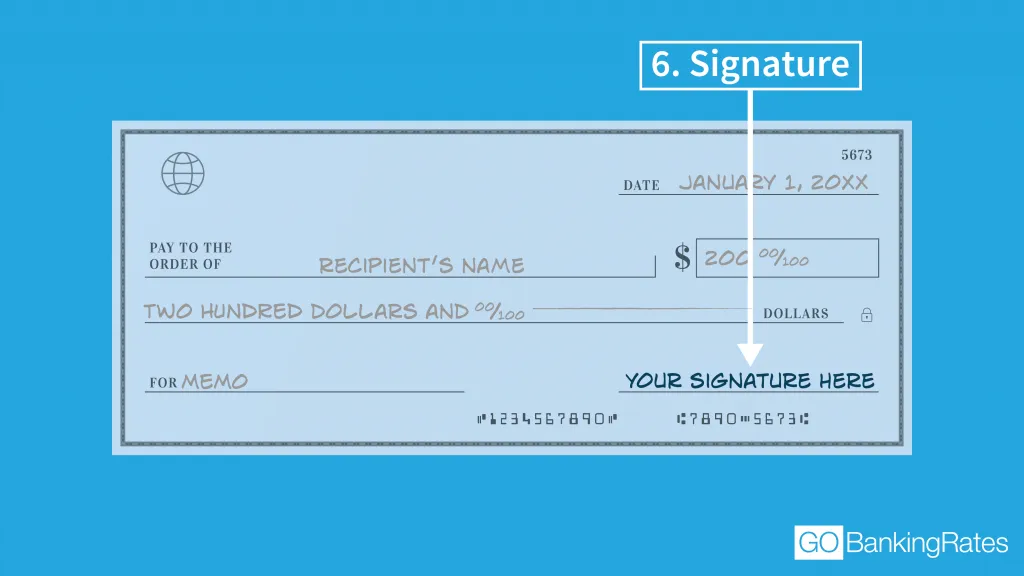

Here’s How To Write a Check — With Examples

Knowing how to write a check can help you avoid costly errors. It’s a good idea to fill in the check from top to bottom so you don’t miss a label.

Financial institutions recommend using a black gel pen to write the check and also to print all words except your signature to make them easier to read. Read on for a step-by-step example of a check filled out from top to bottom.

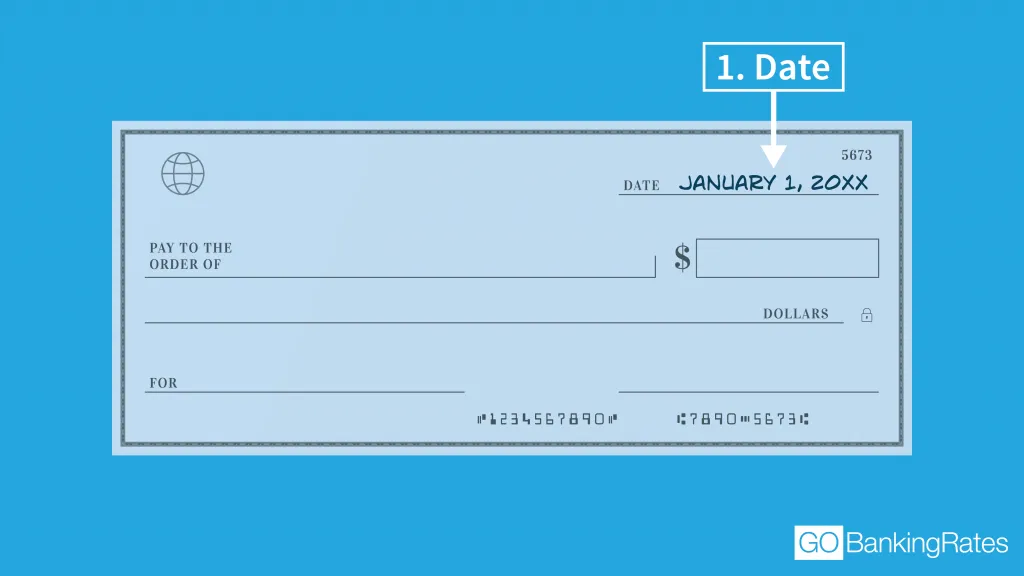

1. Write the Date

Write the correct date in the date label near the upper right corner of the check. Use the current month, day and year. You can postdate a check by writing a future date in the hope that it won’t be cashed until then. However, your account must have enough money to cover the check because the bank can accept a check at any time. The Consumer Financial Protection Bureau says a financial institution is not required to wait for the date on the check.

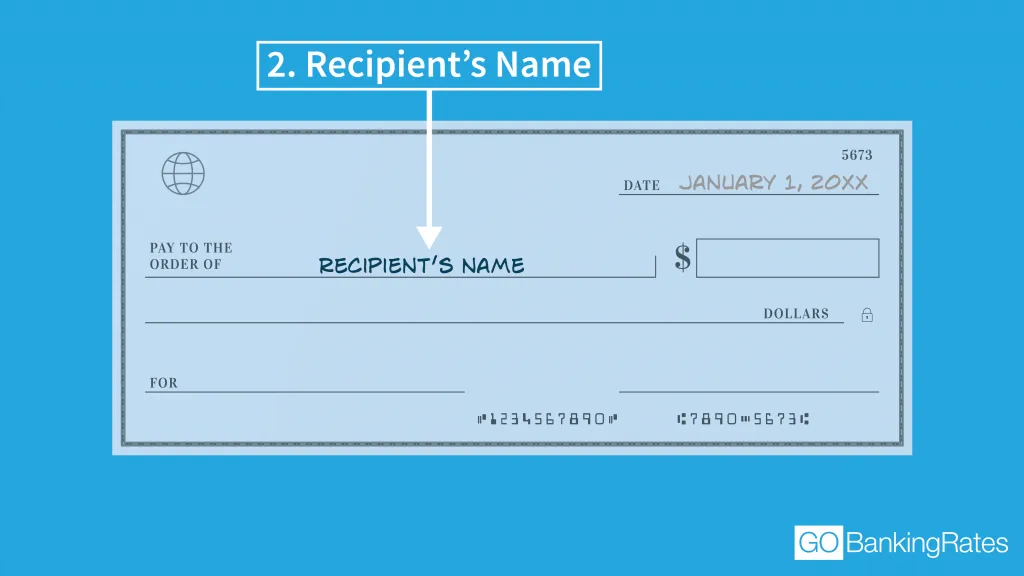

2. Write the Recipient’s Name

Write the full, proper name of the person or company receiving the check on the “pay to” line. You’ll find it in the middle of the check, labeled “Pay to the order of.”

How Do I Write Myself a Check?

You can write your name on the “pay to” line and deposit or cash the check like you would a check someone else had written to you. Alternatively, you can write the check to “Cash,” but keep in mind that doing so can be risky since anyone can cash a check written to cash.

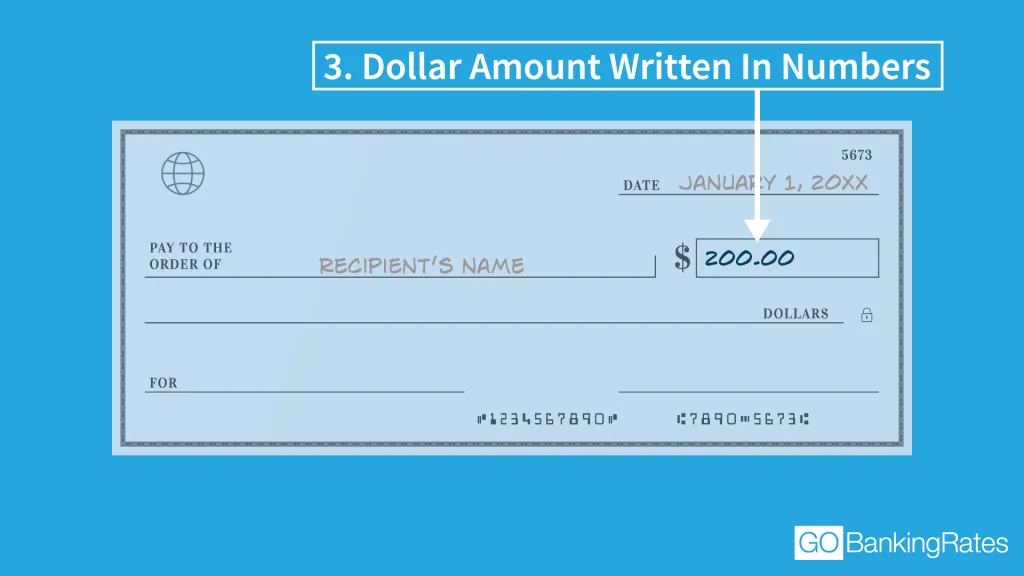

3. Write the Amount in Numbers

You will write the check’s amount in two places. The first is the box to the right of the “pay to” line. That’s where you write the check’s amount in dollars and cents separated by a decimal point. Write the first digit as close as possible to the dollar sign and use a decimal point between the dollars and cents. Even if there are no cents, include a decimal point and two zeros or two zeros over one hundred, like it’s written in the illustration below. This prevents other people from altering the amount of the check.

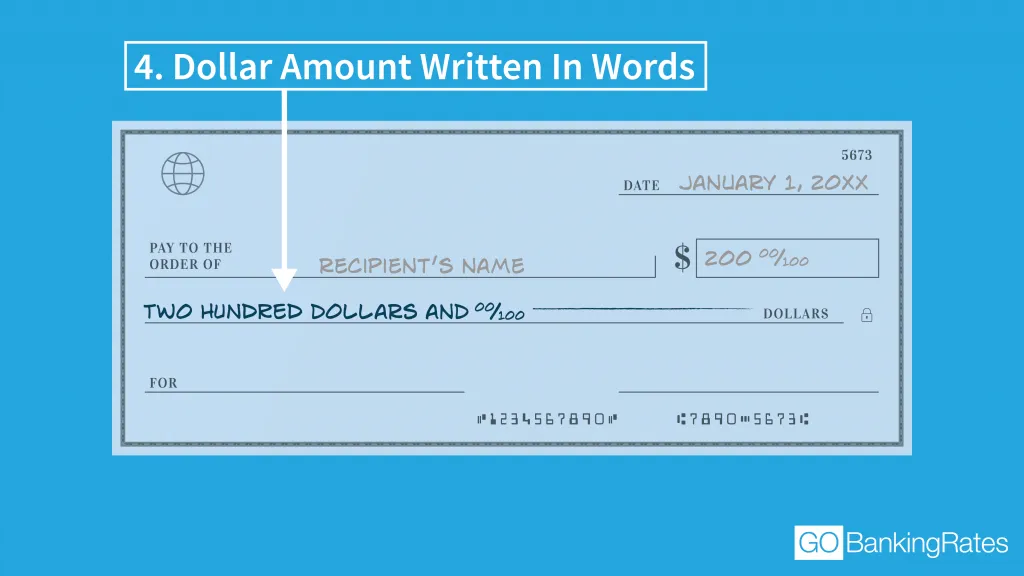

4. Write the Dollar Amount in Words

The second place you write the check’s amount is under the “pay to” line. Here, you’ll spell out the check amount. The amount written out on the line must match what you wrote in the box above the line. This serves as an additional confirmation of the amount the check is written for. The word “and” is used to indicate the decimal point and should always be used.

How To Write Cents on a Check

You might find yourself wondering: How do you write a check for $1,500.75? Start by writing the dollar amount in words, then express the cents as a fraction using xx/100. So, in this example, write “One thousand, five hundred and 75/100” to indicate the dollar amount and 75 cents. Because the word “dollars” is printed on the check, you do not need to write that yourself.

5. Add a Memo

The memo line in the bottom left corner of the check is where you can write a note, such as one that indicates the purpose of the check for your recordkeeping. You can also write a note that indicates your account number when paying a bill to help your payment get properly credited.

6. Write Your Signature

After you’ve filled out all the other sections of the check, sign the check on the signature line in the bottom right corner. Your signature indicates to your financial institution that you want to pay the payee the amount written on the check and have the funds subtracted from your account balance. Use the same signature style your bank has on file. If your signature looks different from the bank records, your check may not be valid.

Remember To Record the Checks You Write

Even though you might not write many checks, it’s still important to have a record of those you do write and subtract their amounts from your bank balance to know just how much money you have in your account.

Keeping a record of checks you’ve written is easy. When you receive your checks from the printer, you should also receive a check register. A check register is where you can record not only any checks you write but also any deposits or withdrawals you make, as well as debit card purchases. This helps you keep a running record of your bank account balance. For each check you write, you’ll need to record the number of the check, the date, the payee and the amount paid in the check register.

If writing in a check register isn’t preferable, you can keep a record of your transactions, including checks, in an electronic spreadsheet or a financial tracking app. Your recordkeeping method doesn’t really matter as long as it’s effective in helping you keep tabs on the amount of money you have.

What If You Make a Mistake?

Even the most experienced check writer can make an error when making out a check. If you write a check for $1,000 but you meant to make out the check for $1,050, write “VOID” across the check, and be sure to mark the check number as void in your check register or on your spreadsheet.

If you have a paper shredder, take advantage of it. Should a fraudster get a hold of your voided check, it can’t be cashed, but it still contains valuable information that could lead to identity theft.

Check Writing Safety Tips and Takeaways

Check fraud includes forging or endorsing checks that belong to someone else, using chemicals to remove information from a check, and stealing or counterfeiting checks that belong to another person. If you use checks, even rarely, make sure you know how to protect yourself from check fraud.

Ways To Prevent Fraud

Take these precautions to avoid being a fraud victim:

- Use pigment-ink pens to write checks.

- Fill out the entire check before signing it.

- Keep your signature consistent.

- If you make a mistake, write the word “VOID” in capital letters across the entire front of the check before shredding it or tearing it up.

The bank may refuse to reimburse you for loss resulting from check fraud if it can prove the fraud was the result of your own negligence.

More on Checking Accounts

- What Is a Checking Account and How Does It Work?

- 7 Types of Checking Accounts

- Checking vs. Savings Accounts

- How Many Checking Accounts Should You Have?

- How Much You Should Have in Your Checking Account

- What Do You Need To Open a Checking Account?

Virginia Anderson, Jami Farkas, Cynthia Measom, Daria Uhlig, Sean Dennison and Barb Nefer contributed to the reporting for this article.

This article has been updated with additional reporting since its original publication.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Premier Community Bank. 2023. "Check Washing: How to Avoid this Scam."

- Members First Credit Union of Florida. 2022. "What to Shred and When to Shred It."

- Consumer Financial Protection Bureau. "Can a bank or credit union cash a post-dated check before the date on the check?"

- HelpWithMyBank.gov. "The bank said forged checks were due to my negligence. What can I do?"

Written by

Written by  Edited by

Edited by