The Future of Banking 2024: What Are the Next Digital Trends for Money Management?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

In an increasingly digital world, many of the products and services we need are right at our fingertips, 24/7. We can summon a ride to anywhere, get groceries delivered to our doorstep or book a same-day hotel.

The digital revolution has also drastically changed the way we bank. We no longer need to visit a bank branch to make a deposit or apply for an auto loan. This has led to the rise of online-only banks and neobanks, which often offer attractive perks to customers that they wouldn’t get at a traditional brick-and-mortar bank. But what are the tradeoffs? And are Americans fully embracing this new tech-forward form of banking?

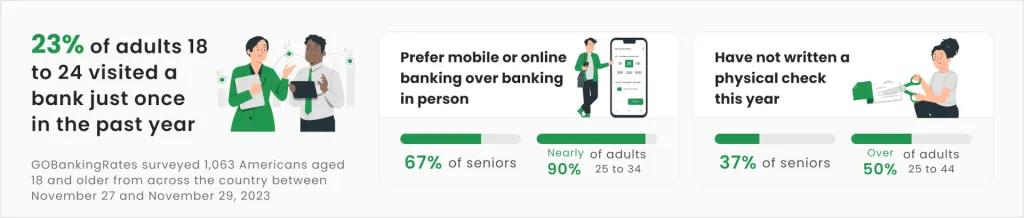

To better understand how Americans’ banking habits are evolving, GOBankingRates surveyed more than 1,000 Americans ages 18 and older from all across the country.

Key Findings

- Even among seniors (ages 65 and older), mobile and online banking is strongly preferred over in-person banking. 67% of seniors said they would rather bank online or on an app than in-person. Across all generations, 78% of Americans prefer mobile and online banking.

- 46% of Americans have not written a physical check in the past year.

- Nearly 1 in 4 Americans did not visit their bank in person this year.

The Rise of Neobanks

The latest advancement in the world of digital banking is the rise of neobanks. These are fintech firms that offer apps, software and other technologies to streamline mobile and online banking. Neobanks typically specialize in a particular financial product or products, such as checking and savings accounts.

Many Americans are open to embracing these new offerings, with 47% saying that they are using or have considered using a neobank within the past year. Younger generations are more likely to be open to this new technology: 54% of Gen Z adults, 53% of young millennials (ages 25 to 34) and 65% of older millennials (ages 35 to 44) said they have considered using a neobank.

In-Person vs. Digital Banking: What Are the Pros and Cons?

It remains to be seen if traditional brick-and-mortar banks will become a thing of the past as we transition more and more into a digital-only landscape. For now, we have options, and it’s worth weighing them to see whether banking in-person or online will better serve your needs.

Pros of In-Person Banking

There are several advantages to banking at a physical location.

“At the branch, people can conduct transactions, including more complex ones, and also get advice,” said Sonali Divilek, head of digital products and channels at Chase. “They can talk to a banker about how to grow and build a small business, get information on home loans and the process of owning a home, and other important conversations on how to make their money support their goals and their future.”

Cons of In-Person Banking

While you might desire the personal touch that in-person banking can provide, it’s not without its downsides. For starters, you might not have easy access to a physical branch.

“Customers must visit a physical branch during operating hours, which may be inconvenient for those with busy schedules or limited mobility,” said Sumeet Grover, chief digital and marketing officer at Alliant Credit Union. “In-person banking is also inherently limited by the physical locations of branches, potentially excluding customers who live in remote areas.”

Traditional banks may also be more costly for the consumer.

“Maintaining physical branches can be expensive, potentially leading to higher fees and less competitive interest rates for customers,” Grover said.

And, let’s not forget that time is money, so physical branches can be more costly in this regard as well.

“In-person transactions may take longer than digital transactions, as customers may need to wait in line or schedule appointments,” Grover said.

Pros of Digital Banking

Online-only banks and neobanks come with a unique set of advantages. One major pro is the convenience factor.

“Digital banking offers unparalleled convenience, allowing users to perform transactions, check balances and manage their accounts anywhere with an Internet connection,” Grover said. “Customers can access accounts and conduct transactions at any time of day, providing flexibility and responsiveness to their financial needs. Digital banking transcends geographical boundaries, making it easy for consumers to manage their finances globally without needing physical branches.”

In addition, many digital banks offer fee-free accounts and high interest rates.

“Operating solely online often results in lower overhead costs for the financial institution, leading to better interest rates and lower or no customer fees,” Grover said.

Finally, digital banks may offer more advanced features than you might find at a traditional bank.

“Digital banks often leverage technology to provide innovative features such as budgeting tools, financial insights and customizable alerts,” Grover said.

Cons of Digital Banking

Digital banks are not without their drawbacks.

“Despite the trend to all things digital, there are many people who still value a firm handshake and smiling face when it comes to the trust of their money,” said Lori Gravitt, assistant vice president and branch manager at Addition Financial Credit Union. “In-person banking customer service is hard to replicate in an online banking platform.”

Another downside is that it is more difficult to make cash transactions.

“Digital-only banks may not offer in-person services like cash deposits or withdrawals, which could be inconvenient for customers who prefer these options,” Grover said.

Overall Survey Results

Have you considered using any app-only banking platforms (aka neobanks) in the past year (e.g. Current, Chime, Dave, etc.)?

| Yes | 47% |

| No | 44% |

| I have never heard of such platforms | 9% |

In the past year, how often have you written a physical check?

| I have not written a physical check in the last year | 46% |

| I write a few checks a month | 15% |

| I wrote less than six checks this past year | 17% |

| I wrote over 12 checks in the past year | 4% |

| Once a month | 17% |

When was the last time you visited your bank in person?

| Earlier this year | 17% |

| I have never visited my bank in person | 6% |

| Last year | 6% |

| My bank is online only | 5% |

| Over two years ago | 8% |

| Within the last couple of months | 20% |

| Within the last month | 37% |

Methodology: GOBankingRates surveyed 1,063 Americans ages 18 and older from across the country between Nov. 27 and Nov. 29, 2023, asking 22 different questions: (1) What category best describes your current financial institution?; (2) Have you considered changing banks within the past year?; (3) If you have considered changing banks in the past year, were any of the following factors? (Select all that apply.); (4) Which feature, perk or other offering is most important to you when opening an account with a new institution?; (5) Are you currently satisfied with all of the banking products and services offered by your bank/credit union?; (6) Would you ever have different types of accounts across multiple banks (i.e. checking at Chase, but savings at TD Bank)?; (7) What is your most preferred method of banking?; (8) Which of the following is the biggest factor of you staying with your current bank?; (9) Which of the following bank accounts do you currently use/have open? (Select all that apply.); (10) How much is the minimum balance you keep in your checking account?; (11) How much do you currently have in your savings account?; (12) What amount of a sign-up bonus would make you consider switching banks?; (13) Have you considered using any app-only banking platforms (aka neobanks) in the past year (e.g. Current, Chime, Dave, etc.); (14) How important is it to you for your bank to be affiliated with a crypto exchange/platform?; (15) In the past year, how often have you written a physical check?; (16) When was the last time you visited your bank in person?; (17) Why would you choose to visit your bank in person? (Select all that apply.); (18) Have you had an overdraft on your checking account in the past year?; (19) How much do you trust your current bank to act in your best interest?; (20) How much do you trust your current bank to protect your private information?; (21) Do you trust regional banks more than national banks?; and (22) How much cash do you keep at home? GOBankingRates used PureSpectrum’s survey platform to conduct the poll.

More From GOBankingRates

Written by

Written by  Edited by

Edited by