Rachel Cruze: The Easy Way To Pay Off Your Mortgage Early

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Owning a home is often seen as a significant milestone in life, representing stability and success. But the journey doesn’t end with just acquiring a home; it’s equally important to focus on financial freedom, which comes from paying off your mortgage early.

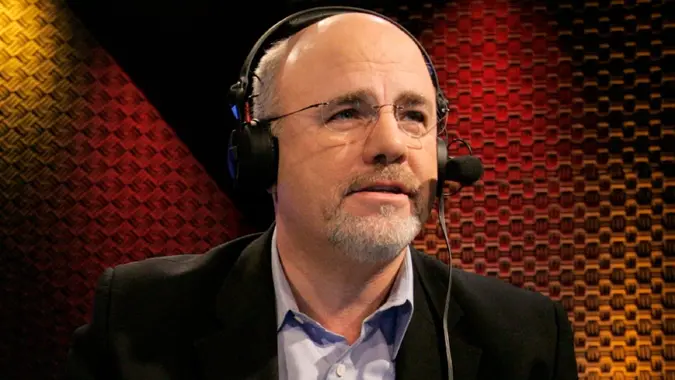

In a recent episode of The Rachel Cruze Show, Cruze shares invaluable advice on how to accomplish this, even when your mortgage payments are high. Here’s a breakdown of Cruze’s approach to achieving this goal.

Understand the Why

Before diving into the “how,” it’s important to understand the “why” behind the goal of paying off your mortgage early.

According to Cruze, the amount of interest paid on a 30-year mortgage can be staggeringly high. By paying off your mortgage early, you’re not only saving on interest but also freeing up significant financial resources.

Imagine the possibilities if you had no longer had house payment: more money for savings, investments, or even just to enjoy life.

Prepare Financially

Ensuring your finances are in a solid place is step one. Owning a home before you’re financially ready can lead to stress and potential financial ruin or bankruptcy.

Cruze emphasizes the importance of being debt-free, having an emergency fund and saving for future expenses before focusing on paying off your mortgage.

This foundation ensures you’re in a strong position to tackle your mortgage without jeopardizing other financial goals or needs.

Four Simple Strategies To Pay Off Your Mortgage Early

1. Make Extra Room in Your Budget

The first strategy you should try is creating some breathing room in your budget. This could mean cutting back on dining out, cancelling unused subscriptions or finding other ways to save.

These savings can then be redirected towards your mortgage, accelerating the payoff process.

2. Refinance to a 15-Year Mortgage

If possible, refinancing from a 30-year to a 15-year mortgage can be a game changer. This move may increase your monthly payments but will save you a fortune in interest over time and force you into a quicker payoff period.

However, before you take this route, make sure the math works in your favor, considering current interest rates.

3. Make Extra Payments

Start with one extra mortgage payment per year and gradually increase from there. This strategy reduces the principal faster and, as a result, decreases the amount of interest paid over the life of the loan.

Extra payments directly to the principal can significantly shorten the length of your mortgage and lead to substantial interest savings.

4. Consider Downsizing

If your mortgage payments consume a large portion of your income, downsizing might be a wise choice.

Living in a more affordable home can provide the financial leeway needed to pay off your mortgage quicker and pursue other financial objectives, such as saving for retirement or your children’s education.

Take Control of Your Money

Cruze explains that while paying off your mortgage early requires discipline, planning and a bit of sacrifice, the rewards are well worth the effort.

Using budgeting tools — like the EveryDollar budgeting app — to help you manage your money more effectively and progress toward your goal. By taking control of your finances and making intentional choices, you can pay off your mortgage early and enjoy some financial stability.

Editor's note: This article was produced via automated technology and then fine-tuned and verified for accuracy by a member of GOBankingRates' editorial team.

More From GOBankingRates

Written by

Written by