Fox’s Liz Claman Offers a ‘Tiny Bit Painful’ Formula for Your Monthly Investing

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

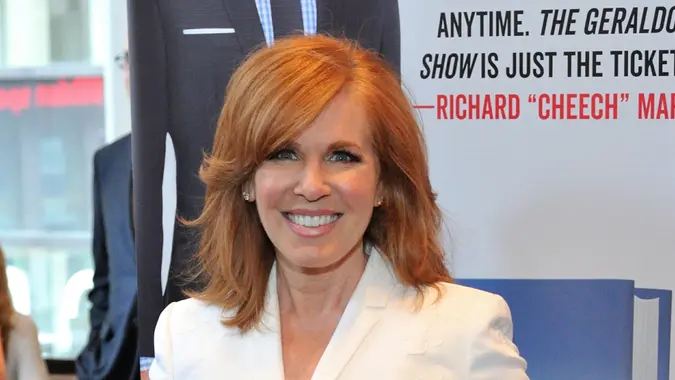

Liz Claman, host of Fox Business Network’s “The Claman Countdown,” has interviewed some of the most successful investors in the world, including Berkshire Hathaway CEO Warren Buffett. Through her decades as a business and financial reporter, she has accumulated a plethora of money advice on investing, building wealth and more.

Here’s why Claman, who is one of GOBankingRates’ Money’s Most Influential Women, believes everyone should be investing — and how much they should be investing each month.

Why Claman Believes You Need To Be Investing

Claman’s top piece of money advice is to start investing now.

“I don’t care if you’re 8 or 58,” she told GOBankingRates. “Take a fixed amount and invest it every month, no matter what the market is doing.”

To determine how much you should be investing, Claman said to “look at your monthly income, pick a dollar amount you think you could subtract without affecting your ability to pay your rent [or] mortgage and bills — then add just a little bit more to make it a tiny bit painful.”

Once you’ve figured out how much to invest, Claman said to set up an automatic monthly deduction that goes directly into a stock fund.

“Warren Buffett has said time and time again to just buy the S&P 500, meaning a piece of the 500 best American companies,” Claman said. “You can do that by picking any one of a number of exchange-traded funds (ETFs) that mirror the S&P. Then don’t touch it! Over time, the stock market has returned way more than just about any other investment. Keep in mind: Some years it will shrink, some years it will expand — so leave it alone for the long term.”

Don’t Skimp on Your Investments

Contributing to your investments every month may take discipline and sacrifice, but it will pay off in the long run, Claman said.

“You must forgo current pleasure for future gain, meaning if you pass up that second $5 cappuccino of the day or that fast-fashion outfit that may be fabulous in the moment but will disintegrate after two washes, you’ll actually create money to save without getting a raise,” she said. “Once you get in the habit of making small changes, you’ll find you do have more money to save than you thought.”

Invest In Yourself

In addition to investing in the stock market, you also should always be investing in yourself, Claman said.

“Take an extra class in your field that you can use on your resume or to indicate to your current employer you’re willing to go much further than your competition/colleagues to grow,” she said. “There are a million online courses in just about every field — many of them free — from which you can choose.”

This is advice Claman has taken herself.

“During the pandemic, I invested in a membership to MasterClass, which is an online education platform that offers hundreds of tutorials and lectures in every possible field, given by the very top experts in that field,” she said. “I had the time because the world was locked down and I ended up taking all kinds of business tutorials to build broader knowledge. You build wealth through your career or your passion, but you have to be the No. 1 participant in that process.”

You might even discover new paths to earn money along the way.

“What’s funny is, because I had the MasterClass subscription, I also found myself watching ‘How To Write a Movie Script’ from the famed Aaron Sorkin and ‘How To Negotiate Anything’ by Chris Voss, a former FBI hostage negotiator,” Claman said. “You just never know — self-educating might lead you to the next money-making opportunity.”

Jaime Catmull contributed to the reporting for this article.

More From GOBankingRates

Written by

Written by  Edited by

Edited by