The Average Debt of Americans in Their 20s

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

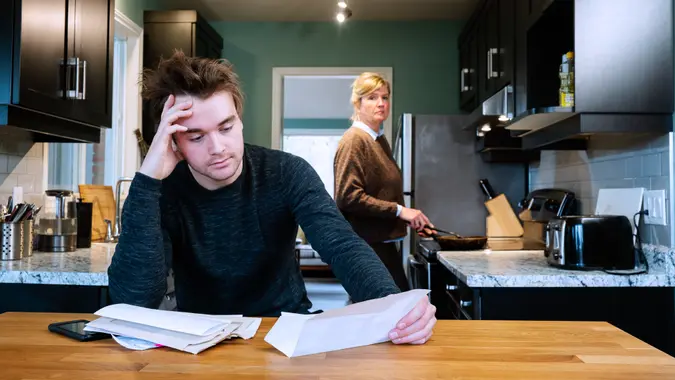

Managing finances and debt in your 20s can be a complex task, given the array of loans and credit options at your disposal. Knowing the average debt carried by Americans in this age group is vital for a clearer understanding of the financial landscape. Keep reading to gain insight into the current debt scenario for those in their 20s.

How Much Debt Does the Average 20-Year-Old Have?

As of 2023, Experian reports that the average non-mortgage debt for Generation Z in the U.S., which includes 20-year-olds, is around $15,105. This amount typically encompasses a range of debts, including student loans, auto loans and credit card balances, indicative of the common financial challenges and lifestyle choices faced by young adults in this demographic.

Here are some key takeaways to know:

- Credit card debt: Individuals in their 20s, on average, have a credit card balance of about $3,148. This figure suggests a trend towards greater reliance on credit cards, possibly due to their convenience and ease of use.

- Auto loans: The average auto loan balance for this age group stands at about $19,223, indicating the challenges of high vehicle prices.

- Student loans: The average student loan debt is approximately $20,468, a significant burden for many young adults entering the workforce or continuing their education.

How To Get Out of Debt: 5 Strategies To Know

For young adults in their 20s looking to manage or reduce their debt, there are several strategies to consider.

Budgeting and Expense Tracking

Establishing a budget is crucial for effective financial management. It involves tracking your income and expenses to gain a clear understanding of your financial situation. By identifying areas where you can reduce expenditures, you can free up more funds for debt repayment.

Staying disciplined with your budget can help you steadily chip away at your debt and prevent the accumulation of additional liabilities.

Prioritize High-Interest Debts

Focusing on high-interest debts, such as credit card balances, is a strategic approach to debt reduction. These debts tend to accumulate interest quickly, making them more expensive over time. By prioritizing their repayment, you can significantly reduce the total interest paid, helping to alleviate the financial burden more efficiently.

Consider Debt Consolidation

Consolidating debt is a practical approach when handling multiple debts. This method consolidates various debts into one loan, ideally with a more favorable interest rate.

This simplification of payments can make it easier to manage your debt and potentially save on interest costs. It’s important to carefully assess the terms of consolidation to ensure it truly benefits your financial situation.

Explore Loan Loan Forgiveness

For individuals with student loans, exploring loan forgiveness programs can provide significant relief. These programs are often available to those in certain professions, such as public service or education, and can result in partial or total forgiveness of the debt.

Understanding the eligibility criteria and application process for these programs can lead to substantial savings and a faster path to being debt-free.

Build an Emergency Fund

Establishing a small emergency fund is a critical component of financial planning. This fund serves as a safety net for unexpected expenses, reducing the need to take on new debt in times of emergency.

Consistently contributing to this fund, even in small amounts, can provide peace of mind and financial security in the face of unforeseen circumstances.

Final Take

The debt landscape for Americans in their 20s is diverse, with credit cards, auto loans and student loans being the most significant contributors. Understanding these debts and implementing effective strategies to manage them is key to financial stability. By proactively addressing debt, young adults can set a strong foundation for their financial future, despite the challenges posed by the current economic environment.

FAQ

Here are the answers to some of the most frequently asked questions regarding debt.- Is it normal to be in debt in your 20s?

- Yes, it's quite common for individuals in their 20s to have some form of debt, often due to student loans, credit cards or auto loans. This period often involves significant life changes like education, starting careers and establishing independence, which can lead to incurring debt.

- What is a good age to be debt-free?

- There's no universal good age to be debt-free as it depends on individual circumstances, including the type of debt and income. However, setting a goal to be debt-free by retirement can be a wise strategy for long-term financial health.

- How much debt is okay?

- An acceptable level of debt is one that you can comfortably manage within your budget without sacrificing essential expenses or savings. A commonly used guideline is the 28/36 rule, where no more than 28% of your gross income should go to housing expenses, and total debt payments should not exceed 36% of your gross income.

Information is accurate as of Feb. 1, 2024.

Editor's note: This article was produced via automated technology and then fine-tuned and verified for accuracy by a member of GOBankingRates' editorial team.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- Experian. 2023. "Experian Study: U.S. Consumer Debt Reaches $16.84 Trillion in Q2 2023."

- Experian. 2023. "Generation Z and Credit in 2023."

Written by

Written by