Dave Ramsey: Here’s the One Debt You Should Refinance Now That Rates Are Lower

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

On Sept. 18, the Federal Reserve made a major rate cut that will make it cheaper for Americans to borrow money. And while it may be cheaper to take on debt, money expert Dave Ramsey said this isn’t a free pass to dig yourself further into the hole by buying things that you can’t actually afford.

“It just sends a message that it’s OK to continue things that are harmful to you,” he said while appearing on “Cavuto Coast To Coast.” “If you’re going to spend more than you make buying things you don’t really need to impress people you don’t even really like with money you don’t have, that’s going to be a problem. It’s not a sustainable life.”

While Ramsey doesn’t condone taking on more credit card debt just because that debt is cheaper, there is one debt situation where he believes the lower rates will be beneficial for Americans.

Also see more advice from Ramsey on how to get out of debt.

The One Debt You Should Refinance Now

If you took out a mortgage when rates were higher, Ramsey said now is a good opportunity to refinance your loan.

“If you refinancing a home, that’s probably a great thing, because you’re going to be saving some serious money on a serious amount of debt,” he said while appearing on the show.

Should You Refinance Your Personal Debts?

If you have personal debts across different credit cards or different institutions, you could consolidate those debts and refinance them for a lower interest rate. But Ramsey advised against doing this.

“When people refinance their personal debts and do a debt consolidation loan, what they end up doing usually is just getting a lower payment, maybe a slightly lower interest rate, but they’ve promised to stay in debt longer,” he said. “Then they don’t change their habits.”

Ramsey believes that refinancing your personal debts can just reinforce your bad behaviors.

“Habits that got them into debt then caused the debt to come back and grow back over here, so we didn’t really get out of debt,” he said. “We just moved it, took a little pressure off, and then built on more debt. So it really doesn’t end up having a great result.”

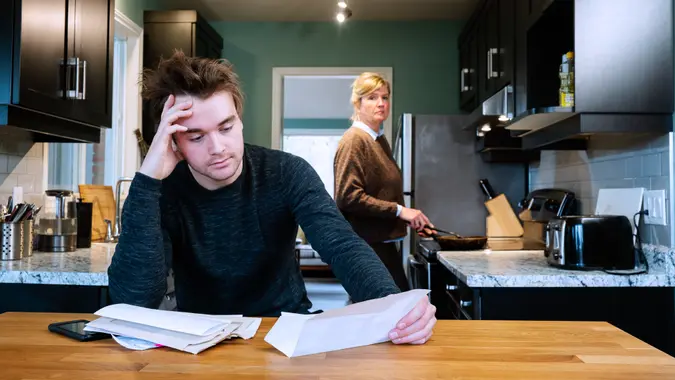

Rather than refinancing your debt, Ramsey said to get serious about paying it off.

“Instead, we’ve got to face that guy, that gal in the mirror, and say, ‘Enough already. I’ve got to fix this,'” he said. “We’ve got to be sick and tired of being sick and tired. When people do that, they have wonderful results.”

More From GOBankingRates

Written by

Written by  Edited by

Edited by