10 Top States Where Women Say They Want To Retire in 2024

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

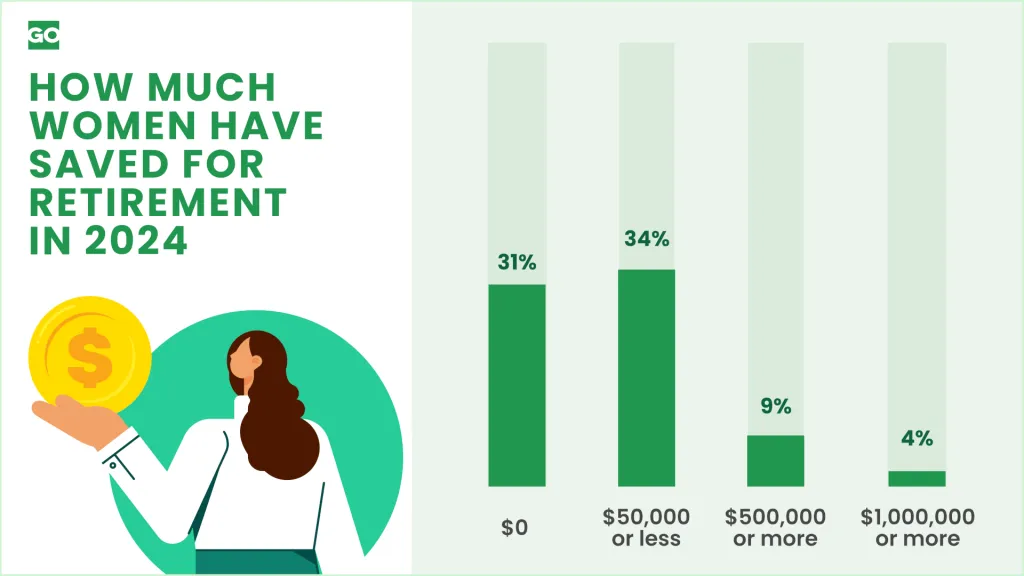

The current state of women’s retirement readiness is pretty troubling. Although half of women believe they will need up to $1 million to retire comfortably, most women (65%) have $50,000 or less saved for retirement, a recent GOBankingRates survey found. Given their lack of savings, it’s no wonder that nearly one-third of women (31%) believe they will never be able to retire comfortably.

Still, some women are planning ahead for their ideal retirement, including where they want to live. It may not be out of reach for them to get there either — if they make smart moves to catch up financially.

Here’s a closer look at women’s retirement readiness, plus the top states women would like to retire in.

Most Women Have Insufficient Retirement Savings

The GOBankingRates survey found that 31% of women have nothing saved for retirement and an additional 37% have less than $50,000 saved. Only 7% of women have over $750,000 saved, with 4% having over $1 million saved.

The proportion of women with insufficient retirement savings is so high because many women are simply not saving for retirement. The survey found that 42% don’t contribute any of their income to a 401(k) or other retirement savings plan.

Where Women Want To Retire

Although women may not have the financial cushion they want for retirement, some are already planning ahead to where they would most like to live during their golden years.

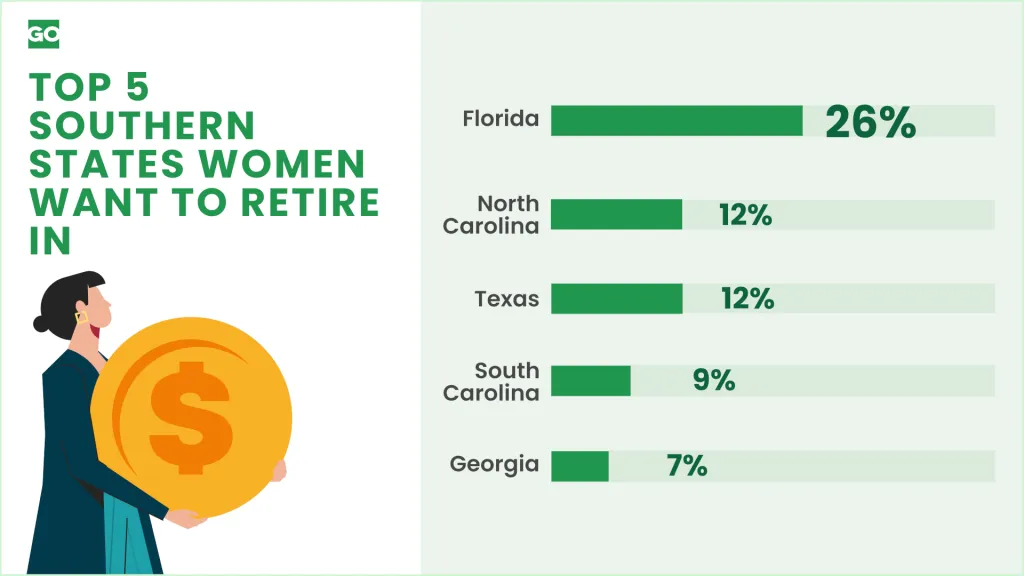

Nearly half of women (45%) would like to retire in the South, a separate GOBankingRates study found. The Southern state women most want to retire in is Florida (26%) followed by North Carolina (12%), Texas (12%), South Carolina (9%) and Georgia (7%).

An additional 16% of women said they would like to retire in the Midwest, with the top retirement destinations being Ohio (16%), Michigan (13%), Missouri (10%), Illinois (10%) and Minnesota (7%).

Another GOBankingRates survey examined what women would consider when choosing where they want to retire, and the largest proportion (28%) said that cost is their top consideration. However, there are a number of factors they would consider. More than half of women said other factors they would take into consideration when choosing where to retire include climate, location, crime and safety, and proximity to family.

Financial Experts Weigh In

Especially given that many women will be tight on money in retirement, experts agree that cost of living should be a top consideration when choosing where to retire.

“Consider evaluating housing costs, taxes and the overall cost of living, whether you’re thinking of downsizing, relocating to a warmer climate or settling into a retirement home,” said Crissi Cole, founder and CEO at Penny Finance. “Zero percent state taxes are definitely a plus, [so consider relocating to] Florida, Texas, Wyoming, Washington, Nevada, Tennessee, New Hampshire, Alaska [or] South Dakota.”

Cole said it’s also important to consider access to healthcare and healthcare costs.

Outside of cost considerations, there are a number of lifestyle factors women should consider when choosing where to retire, said Seth J. Diener, founding advisor at Oak and Stone Capital Advisors.

“When advising women on choosing a place to retire, it is important to prioritize a safe, affordable and fulfilling retirement experience,” he said. “Selecting a location with low crime rates and a strong community watch program can provide peace of mind.

“A sense of community is key for social engagement and support networks,” Deiner continued. “Choosing a location with active senior centers, community events, and opportunities for volunteering or pursuing hobbies can foster a sense of belonging and purpose in retirement. Access to healthcare services and amenities tailored to senior needs, such as recreational facilities and cultural activities, can enhance quality of life and overall well-being.”

Deiner agrees that Florida and North Carolina are both great possible retirement locations.

“I would recommend for women retirees cities like Asheville, North Carolina, known for its vibrant community spirit, affordability and access to healthcare,” he said. “Sarasota, Florida, is also noted for its safety, cultural amenities and active senior programs, providing a nurturing environment for retirees seeking a balanced and fulfilling lifestyle. Ultimately, the ideal retirement location will align with individual preferences and priorities, ensuring a secure and purposeful retirement journey.”

Methodology: GOBankingRates surveyed 1,005 Americans ages 18 and older from across the country between Jan. 23 and Jan. 26, 2024, asking six different questions: (1) What is more important to you in a job/career?; (2) What is the minimum annual salary that would make you feel happy?; (3) How much do you believe you will need in savings in order to retire comfortably?; (4) How much do you currently have saved for retirement?; (5) Do you think you will be able and prepared to retire at 65?; and (6) What percentage of your salary do you put towards a retirement plan such as a 401(k)? GOBankingRates used PureSpectrum’s survey platform to conduct the poll.

Methodology: GOBankingRates surveyed 1,395 Americans ages 18 and older from across the country between Feb. 26 and Feb. 28, 2024, asking six different questions: (1) Which part of the U.S. would you prefer to live in when you retire?; (2) Which state in the South do you consider to be the best place to retire?; (3) Which state in the Midwest do you consider to be the best place to retire?; (4) Which state would you choose to move to if you had to relocate to the Midwest?; (5) Which state would you choose to move to if you had to relocate to the South?; and (6) Which of the following personal finance issues are most important to you in 2024? GOBankingRates used PureSpectrum’s survey platform to conduct the poll.

Methodology: GOBankingRates surveyed 1,395 Americans ages 18 and older from across the country between Feb. 26 and Feb. 28, 2024, asking 12 different questions: (1) Do you have a specific retirement savings goal?; (2) Will you need to work part-time in retirement?; (3) In retirement, what type of housing/living situation would/do you prefer?; (4) How important is/was proximity to family and friends in choosing a location to retire?; (5) Are you considering downsizing in retirement?; (6) Do you plan to or did you move for your retirement?; (7) Where is your ideal location for retirement?; (8) Which of the following will you consider/did you consider when deciding where to live in retirement? (Select all that apply.); (9) What is the MOST important factor in deciding where you want to retire?; (10) What are you looking forward to in retirement?; (11) How much do you plan to spend monthly in retirement (outside of housing/rent)?; and (12) Which of the following countries would you be most interested in spending your retirement? GOBankingRates used PureSpectrum’s survey platform to conduct the poll.

Written by

Written by  Edited by

Edited by