GOBankingRates

Tax Resource Center

COUNTDOWN TO TAX DAY

Beginner

Intermediate

Advanced

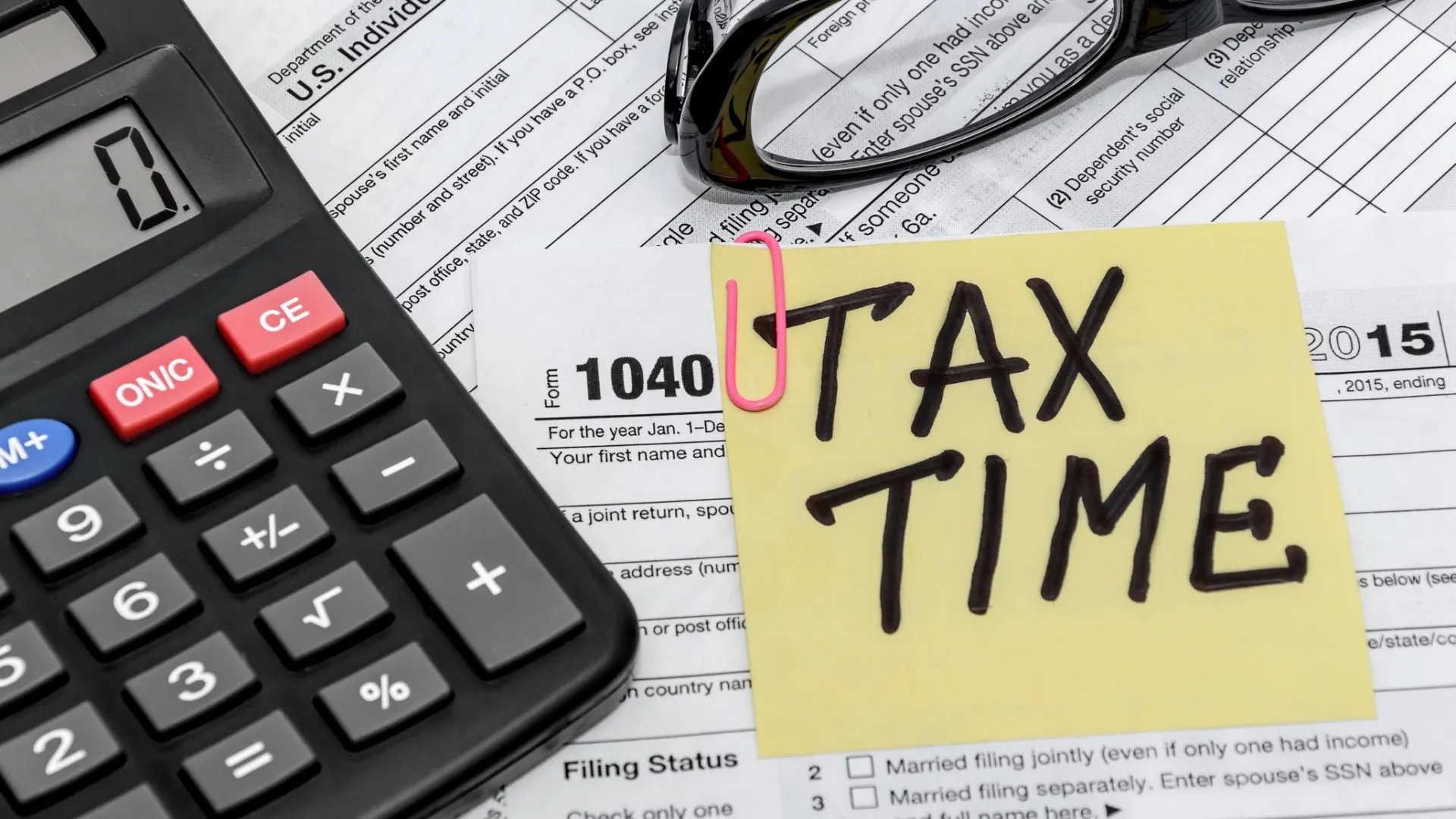

2024 Tax Schedule: Every Date You Need To Know

January 26

Earned Income Tax Credit Awareness Day to raise awareness of tax credits.

January 29

Official start to tax season. IRS begins accepting and processing tax returns.

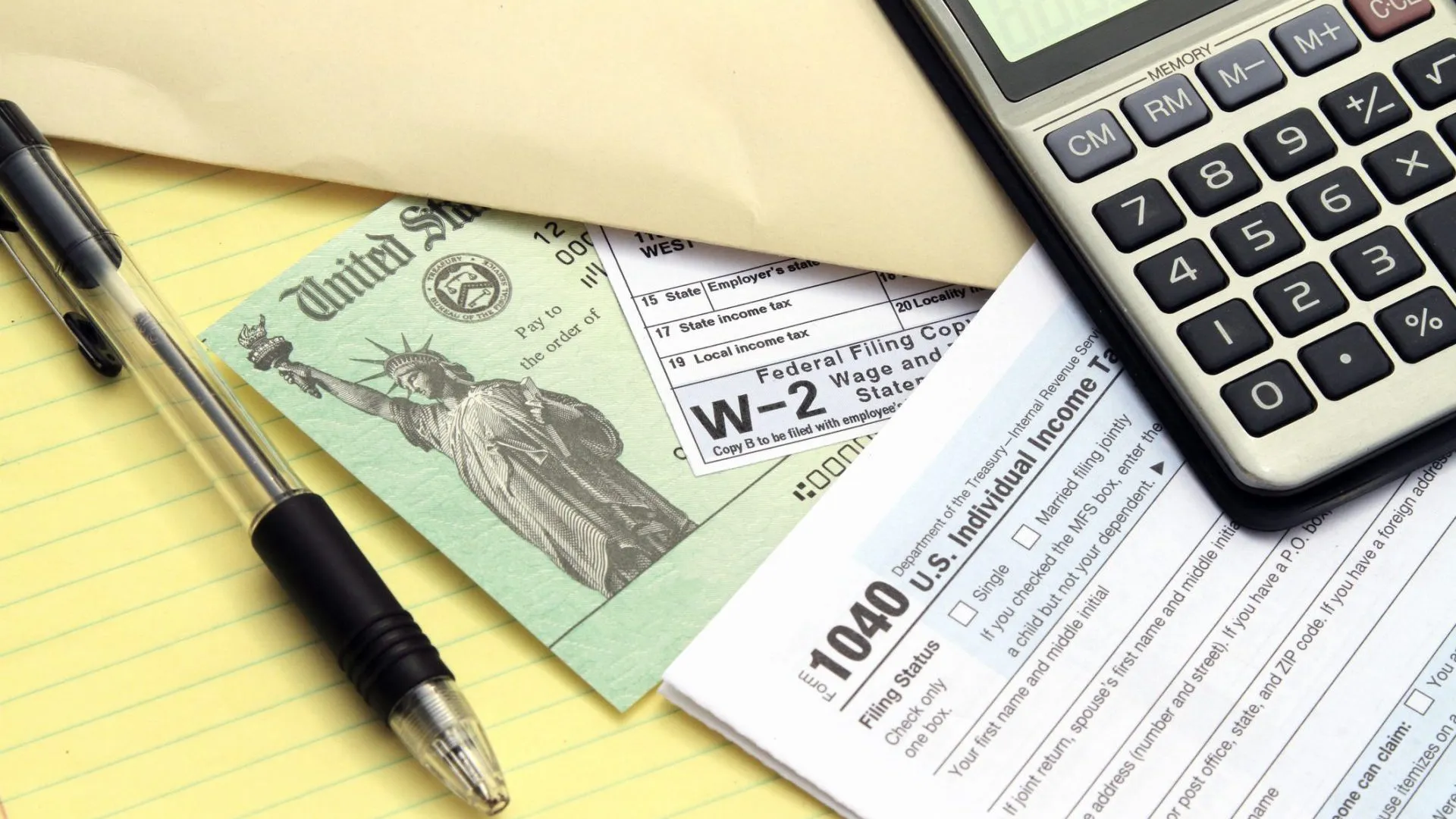

January 31

Employers must send W-2 forms by this date. Certain 1099 forms are also sent.

April 1

If you turned 73 in 2023, you must take your required minimum distribution.

April 15: Tax Day

Deadline to file your personal federal tax return or request an extension.

October 15

If you requested an extension, you must file your return by this date.

READ MORE

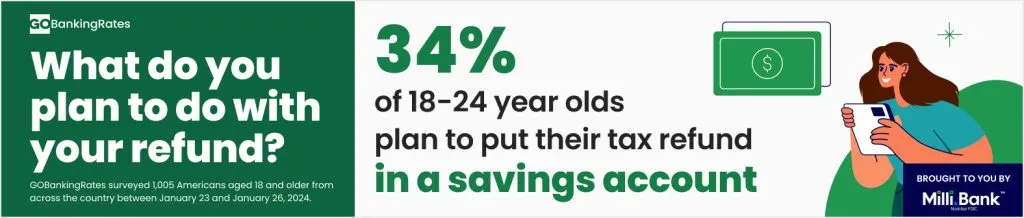

Resources To Help You With Tax Season

Get More Valuable Info