Empowering women to take control of their finances.

13 Things Women in Their 50s Need To Know About Social Security & Retirement Planning

Women in their 50s are now approaching retirement age, but many are not financially prepared for this phase of life. According to a recent AARP study, 64% of women in their 50s say they’re less financially secure than they expected to be, and 59% are not confident they will have enough money to retire at an age they’d prefer. Find Out: Cutting Expenses for Retirement? Here’s the No. 1 Thing To Get Rid of First For You: 9 Easy Ways To Build Wealth That Will Last Through Retirement The good news is that with the proper planning — including an…

Read MoreA Focus On Your Money

Women Are Tapping Into Emergency Savings at High Rates — Why This Can Be a Mistake

Having an emergency savings fund can provide a financial safety net for unexpected costs and events, such as a job loss or medical expense. While it’s OK to use these funds when necessary, a new Bank of America report uncovered an alarming trend — women are more likely to have decreased their emergency savings funds over the past six to 12 months compared to the overall population. According to the bank’s 2024 Workplace Benefits Report, 29% of women have decreased their emergency savings in recent months compared to 23% of all employees. Find Out: How Much Does the Average Baby…

Women and the Workplace

This Is the Salary Women Say They Need To Be Happy in 2024

When asked about the salary needed to be happy, women are more likely to be content with less. A recent GOBankingRates survey found that 30% of women would be happy making $50,000 or less versus 25% of men. Additionally, just under half of all women (49%) would be happy making $65,000 or less. In this “Financially Savvy Female” column, we’re chatting with experts about the salary women actually need to be happy, and why women tend to have a lower threshold for happiness when it comes to income. Read Next: 12 Key Ways the Rich Multiply Their WealthFor You: 6…

Relationships, Family & Finances

Newly Married? Here’s How To Build Wealth as a Couple

We’re currently in the midst of wedding season, which means many couples will be saying their “I dos” and officially merging their lives together. This also means that many couples will be navigating their finances together for the first time. Having frank conversations about money and wealth-building strategies early on can help couples navigate financial highs and lows down the line. See Our List: 100 Most Influential Money ExpertsRead: How To Build Your Savings From Scratch In this “Financially Savvy Female” column, we’re chatting with Cindy Scott, CFP with Schwab Intelligent Portfolios Premium, about how newly married couples can work together to…

The State of Women & Money

What Is the State of Women & Money?

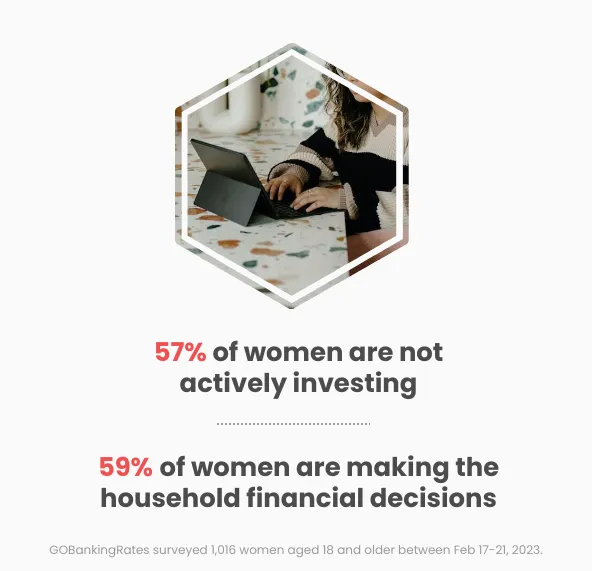

Women have been making major strides in the world of personal finance. A recent LendingTree analysis found that single women now own more homes than single men. And Fortune reported that women CEOs now run more than 10% of the Fortune 500 companies. Still, the gender pay gap persists and women continue to be less likely to invest than men — even though data has shown that they tend to be better investors. To get a complete look at women’s financial standing in 2024, GOBankingRates surveyed over 1,000 American adults who identify as female about their financial obstacles and goals,…

Get More Valuable Info

All of our expert Financially Savvy Female advice in one spot.